It’s good to see the back of October. The first half of the month was dominated by the sixteen day shutdown of the Federal Government; the second half by the sloppy roll-out of the Affordable Care Act’s website and government operated health insurance exchange. Worst of all, the heavy artillery lobbed during the ensuing media war games has caused collateral damage to consumer sentiment and the US economy.

Read More...

The US Congress will pay federal workers retroactively for the work days lost during the shut-down, but it cannot restore income to small businesses serving workers and Federal agencies, cancelled trips, or revenues from shuttered national parks and recreational sites. And then there are the lost opportunities, like the US absence from the Asia Pacific Economic Cooperation meeting (APEC) – where the President and delegations accompanying him meet and market the US to one of the world’s most dynamic regions. Republican lawmakers, particularly in the House of Representatives bore the brunt of the public’s anger, with opinion polls indicating support fell to all-time lows (24%), which may figure in next week’s off-year elections. Since Congress only funded operations for three months, we will revisit fiscal issues again in January, with talks likely to focus in part on across the board spending cuts due to take effect – also known as the sequester.

Any gloating by Democrats was short-lived once Washington returned to work and found that the healthcare.gov website, its reporting mechanisms, and security protocols had serious flaws. The Obama Administration managed the process poorly, and now also finds itself on the defensive (here’s a handy “blame game” chart). The good news is that most folks are cutting the Administration some slack – a poll shows 2/3rds think it’s a short term issue or will reserve judgment for now. The White House anticipates key fixes will be in place by late November and has delayed its marketing campaign until they have a website that works. Lost in the frenzy is that most people get insurance through work and will see more modest changes – only those without insurance or purchasing independently in states that do not have an exchange will be affected. Also, the US Treasury has loosened rules for Flexible Spending Accounts (FSAs) enabling many people putting pre-tax money aside for health expenses to carry up to $500 over to the next year. By contrast, many state-run exchanges are performing better and signing up decent numbers, but not as many as hoped.

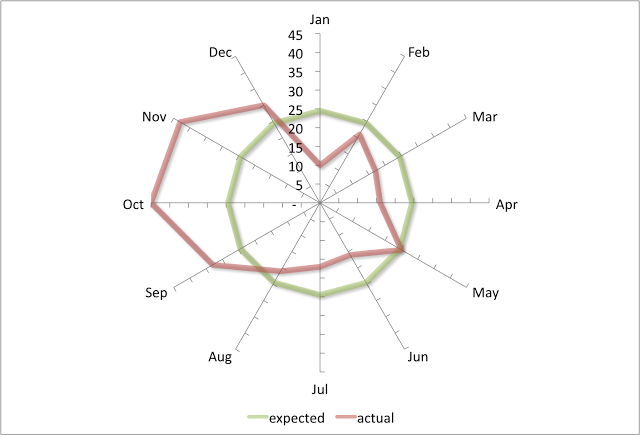

So what’s the damage from all this? Economists may differ on their estimates, but agree that the government shut-down will reduce growth in the fourth quarter (Oct-Dec). Macroeconomic Advisors trimmed their forecast by 0.3% (here’s their calculator) while Standard & Poor’s put the cost $24 billion, reducing growth by 0.6% (here’s their statement). What’s more, recent data released show that growth momentum had slowed before the shut-down took place, with monthly job gains moderating to barely 150,000 from a pace of 180,000 earlier in the year. Retail sales rose 0.2% in August and dipped -0.1% in September, while home sales slowed due to higher prices (up 12.8% year on year according to the Case-Schiller 20 city index) and the increase in mortgage rates during the late spring/summer. The big kicker however was a plunge in consumer confidence, according to national surveys, which does not help retailers as they enter the all-important holiday season.

Source: Bloomberg.com and Econoday

All in all, this has created yet another temporary headwind for the US economy, keeping growth at or below 2% through 2013, delaying ‘the breakout year’ into 2014. But all is not lost — forward looking surveys of purchasing managers in the manufacturing sector rebounded sharply in October, with strong readings on new orders. Energy prices have fallen back, which helps businesses and consumers, and borrowing costs have eased after Federal Reserve officials announced they will maintain their extraordinary stimulus efforts for now, which in turn has helped 30-year mortgage rates dip back to 4.15%. But while the economy giveth, it remains to be seen whether Washington will ‘taketh away’. An across the board cut in supplemental food benefits (SNAP or food stamps) goes into effect today, impacting an estimated 1 in 8 households. And even though the budget deficit fell to 4.1% of GDP in the 2012-2013 fiscal year – its best result since 2007, ongoing budget talks focus on cuts in spending, which can dampen near term growth prospects, rather than longer term changes that can have a more profound and lasting positive impact on the US economy.

The battles of the past month also highlight the fact that in today’s world we all live in glass houses. There has been some bewilderment internationally, and a bit of schadenfreude too now that the US finds itself on the receiving end of advice on how to handle its affairs. While we may find ourselves working within ‘bubbles’ like those in the West Wing, or news outlets that mirror our personal perspectives, it’s only a matter of time before a wider reality sets in. Our connected world no longer protects tyrants, nor does it seem to secure our personal information – and not even world leaders can hide from the spying techniques of the National Security Agency (NSA). Perhaps once we figure out that we all do live in glass houses, we can confront some of our “stone-age” approach to conflicts – it’s not about who’s ‘right’ – but how to resolve them.

*Tipping our hat to the bit – “He who lives in a Glass Houses” from the popular cable television show, Family Guy. Here’s the link http://youtu.be/MGsZwDkk4Eo

Take it to the (Debt) Limit – One More Time

Now Would be a Good Time to Lead:

Speaker of the House John Boehner & President Obama

(Photo source: Washington Post, The Fix, July 2011)

Growth in the US during the second quarter (Q2) was confirmed at a 2.5% annual rate, better than first reported and well above levels seen at the start of the year. A modest but steady recovery was echoed overseas, with China on track to meet its 7.5% GDP estimate, Japan growing at a 3.8% annualized rate thanks to a major stimulus program, and even the Eurozone expanded at a 1.2% annual rate this spring.

But just when you thought we might be on the way to a sustainable recovery, US lawmakers have once again locked horns on fiscal issues. Republicans in the House of Representatives have taken the US government hostage, putting forth their list of demands before they release funding or agree to raise debt ceiling. They include a one-year delay in the implementation of Obamacare, tax reforms along the lines of Paul Ryan’s budget, passage of the Keystone XL Pipeline, drilling for oil on Federal land, and more in a lengthy laundry list. Even Republican advisors and allies call these tactics ‘ill conceived’ and warn that ‘kamikaze missions rarely turn out well’.

Read More...

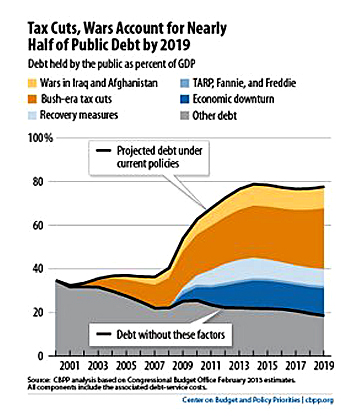

Wall Street and Main Street have largely ignored the political noise because this deeply flawed process has produced results. Thanks to higher than expected tax receipts, income from Fannie Mae & Freddie Mac, and spending cuts, the US Federal Budget deficit has narrowed to roughly -4% of GDP for fiscal year ending September 30, less than half the -10% of GDP gap recorded in fiscal year 2009. That said, the $16.7 trillion pile of debt, equal to about a full year of GDP, has yet to be dealt with in a meaningful way.

So what’s next? Beware the Ides of October: Officials have started to brace for a possible temporary government shutdown starting next Tuesday, October 1. In practical terms it means that, should a temporary shut-down occur, essential services and payments would continue (like Social Security payments), but non-essential services would close. Here’s a list of agencies and links to contingency plans. Macroeconomic Advisors, a leading consultancy, estimates that a temporary government shut-down could reduce US growth by 0.3% in the fourth quarter, with a rebound in early 2014, similar to the drop in growth in the first quarter, followed by a rebound this year. But remember, because the US is very close to its debt ceiling (Treasury Secretary Lew estimates it will exhaust funding measures October 17), this impasse carries the threat of a sovereign default by the US on its obligations.

Risky Business: The largest concentration of “1% worst trading days” in the history of the Dow (Jones Industrial Average) have occurred near October. NOT a good time for a debt ceiling showdown.

Source: Statisticalideasblogspot.in – “The Autumn of Our Discontent” by Salil Mehta

And unlike the fiscal battles of August 2011 and last December, this debt ceiling impasse comes at a sensitive time, for October is highly correlated with stock market ‘events’. News outlets have reported how September has often been the worst month for financial market returns, but a statistical review by Salil Mehta of the worst 1% trading days in the history of the Dow Jones Industrial Average (Dow) indicates that the riskiest times have occurred near October, with a bias toward Mondays (to qualify for this “1%”, index had to fall by 3.2% or more in a single session, or nearly 500 points at current levels). Corporations begin reporting their third quarter earnings results October 8th, and already a number of companies have ‘guided’ expectations lower. With equity indices hovering near multi-year highs, Washington’s missteps could prove costly.

Against this backdrop, it’s no wonder that Federal Reserve officials opted to maintain its extraordinary stimulus efforts a bit longer. Taking a bit of flack for ‘misleading markets’ or ‘missing an opportunity’ may be the least of their concerns. With just a few days to go, pundits warn a temporary government shut-down could well occur, enabling hard liners to show they ‘delivered’ on their threat, clearing the way for another continuing resolution to fund the government, with a possible extension of automatic spending cuts (the sequester) into the 2013-2014 fiscal year. A temporary shut down could focus Wall Street’s attention in a hurry, reminding everyone of the potential costs to business, households, and the real economy. That’s messy but manageable. But as we learned with the housing crisis, just because something hasn’t ever happened yet doesn’t mean it can’t.

America’s sovereign ‘debt mountain’ — it won’t disappear by itself and a default, even temporary, could trigger sharp increases in borrowing costs (like a missed payment on a credit card), impacting mortgages, lines of credit, and business loans.

Source: Center on Budget and Policy Priorities, Daily Beast

** Since this is ‘déjà vu all over again’ we return to the classic Eagles hit, Take it to the Limit. Here’s a link to a video of a live performance.

It’s been a long, a long time coming

But I know a change gonna come

(Sam Cooke – 1963)

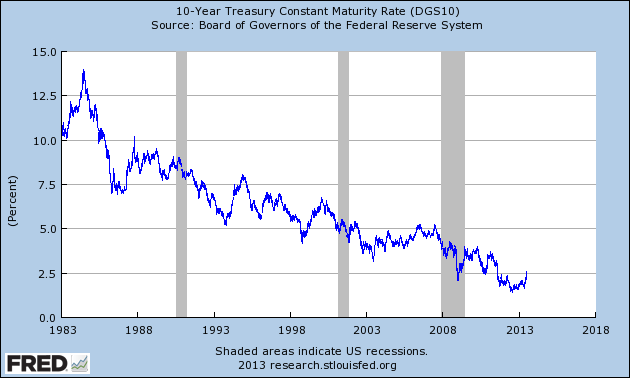

From civil unrest around the globe, prayers for the ailing Nelson Mandela, to landmark Supreme Court decisions, we are witnessing chapters drawing to a close as others struggle to emerge. With change comes uncertainty and volatility, which could also describe financial markets of late. Yields on US Treasury securities were backing up for weeks, but Federal Reserve Chairman Ben Bernanke’s announcement that the Fed could begin tapering down its purchases of fixed income securities later this year sent yields sharply higher. The US Treasury 10-year note yields 2.48%%, up from 1.6% in early May; this in turn pushed the average 30 year mortgage rate to 4.375%, versus 3.75% a month ago.

Read More...

Let’s be clear – the Fed has not taken any action yet. Its purchases of US Treasuries and mortgage securities, which are running at $85 million per month, will remain steady for now, with the plan to slowly reduce them later this year – should conditions warrant. Chairman Bernanke and senior officials have emphasized its Fed Funds target rate remains unchanged at 0 – 0.25%. Fed parameters say it will consider raising benchmark rates when headline unemployment falls below 6.5% and inflation rises about 2.5%. With inflation subdued for now at less than 1.5% annual rate, and headline unemployment a full percent below the Fed’s target, we’ve got a ways to go. Forecasters anticipate a gradual acceleration in US growth starting later this year, leading to an eventual tightening of monetary policy later in 2014 to early 2015.

So if growth remains modest and the Fed’s overnight borrowing rate will remain near zero, why the sell-off? The chart below of 10 Year US Treasury yields, shows that in the big picture, US interest rates have steadily moved lower since the mid-1980s. While some investors may be perfectly willing to hold their securities to maturity, others – especially those who trade regularly – read the Fed’s announcement as a signal that this trend has likely run its course. So they’ve begun to sell their holdings to lock in profits.

Are we witnessing the end of an extended decline in US bond yields?

(Source Federal Reserve Bank of St. Louis)

?

And the numbers confirm this move — bond funds and exchange traded funds faced record redemptions of $61.7 billion through June 24th, surpassing the previous record of October 2008. At the same time, money market funds saw assets rise by over $8 billion in the week ending June 25, indicating some investors have decided to get out of the market and hold their money in these low yielding short term funds to keep their options open.

That makes good sense, because a number of wildcards continue to concern markets. Once again international events and geopolitical pressures pose more of a threat than economic imbalances, though global growth forecasts have been revised lower. For example, Chinese authorities, in an effort to send a message to banks that it intends to rein in lending excesses, Chinese did not step in at quarter-end to address rising cash needs, resulting in a spike in short term interbank lending rates. With Chinese banks needing liquidity, they sold US Treasuries (and other holdings), exacerbating a spike which sent the 10 year yield to 2.71%, with some watchers speculating that cash strapped Chinese might have sold US Treasuries temporarily to raise liquid funds. Having made their point, the Peoples Bank of China intervened on June 25th, providing liquidity to the market, easing pressures.

We are reminded that just as early signs of recovery were derailed in 2011 by the Arab Spring and tsunami in Japan, civil strife in a number of countries, slower growth in China, and other surprises could potentially rain on our parade again. As events in Egypt have deteriorated rapidly, investors fled mutual funds focusing on emerging market bonds, withdrawing estimated $5.6 billion in the week ending June 26.

Ironically, the Fed’s discussion on withdrawing its unprecedented support of financial markets represents a sign of healing. And with the US budget deficit shrinking rapidly, authorities may reduce auction sizes in coming months, so that the ‘tapering down’ of extraordinary bond purchases would coincide with a period of dwindling supply. Nevertheless markets have become accustomed to this IV drip of money, and they are demonstrating symptoms of withdrawal. These developments remind us linkages in our markets and global economy tether us closer together than ever. And given the rise in foreign holdings of US Treasury securities, the impact now goes in both directions. So take a deep breath, because a change ‘gonna come.

** Sam Cooke’s classic, A Change Gonna Come (listen here), became an anthem of the US civil rights era, and adopted by agents of change around the world.

Will there be growth in the spring?**

We welcome the inevitable seasons of nature,

But we’re upset by the seasons of growth in our economy.

(From the film, Being There – click HERE for clip)

After an unexpected pull-back in the economy late last year as the US teetered on the ‘fiscal cliff’, politicians, analysts, investors, and gardeners shared the view that yes, there will be growth in the spring. Stronger demand for housing and autos, a catch-up spurt in manufacturing to replenish low inventories, and ongoing business investment combined to offset tighter fiscal policy. Growth in the first quarter of 2013 (due out April 26) will rebound sharply from the paltry 0.4% gain (itself an upward revision) posted in late 2012, with some analysts forecasting a 3% annualized rate.

Read More...

The March employment report is a case in point. Payroll job gains slowed substantially, up only 88,000, less than half the average gain of the past 12 months (169,000), with weakness in the retail sector, sluggish gains in manufacturing, and ongoing trimming of public sector payrolls. Unemployment ticked down to 7.6%, not because of job gains, but because nearly ½ million people stopped looking for work altogether. One report does not make a trend, and need a bit more time to see how much of this may be attributed to the harsher weather in March, early Easter, and the impact of budget cuts.

Different year, same pattern – activity begins the year on a positive note and slows into the spring. In 2011 it was the earthquake in Japan and Tsunami combined with the Arab Spring, and in 2012 growth slowed in China while the Greek financial crisis and its impact on the Euro took center stage. And fiscal tightening and debt drama has taken its toll on US growth. Less than a fortnight ago Chairman Ben Bernanke and senior policy makers at the Federal Reserve began discussing how they might eventually begin to withdraw the extraordinary stimulus measures taken to support growth. If the latest data indicating some softening of the labor market and a somewhat slower growth momentum going into the spring hold true, we could see yet another ‘spring slowdown’.

The same holds true for Europe, where the financial sector meltdown in Cypress looks unlikely to rock the core of the Eurozone, however the deep spending cuts imposed by governments to close large budget gaps, has the region mired in a vicious negative circle. Unemployment reached 12% for the Eurozone overall in February, the highest level recorded (data since 1995), with sharp regional differences. Youth unemployment topped 55%% in Spain and Greece, 38% in Italy, while unemployment (overall) was 7.7% in the UK an 5.4% in Germany. The European Central Bank forecasts that growth will decline another -0.5% in 2013, with no clear path back to growth.

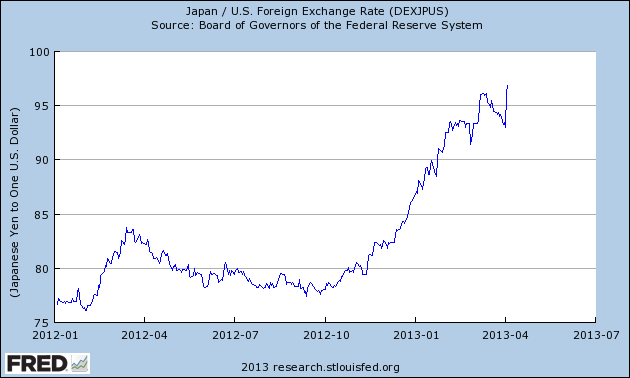

That is something Japan can also relate to – after all, it has had a lost decade with virtually no growth and is stuck in a deflationary spiral and a series of short-lived governments. Prime Minister Abe has embarked on a bold new policy to jumpstart growth and ‘reflate’ the economy – flip it from a negative spiral of falling prices, wages, and output into a more virtuous circle. Bank of Japan Chief Kuroda has a 2% inflation target , but detractors warn the country risks creating a ‘race to the bottom’ in international currency markets. Already the Yen has fallen sharply against major currencies this year, declining from 86 Yen per dollar in January to 99 Yen to the dollar today.

Source: Federal Reserve of St. Louis

Source: Federal Reserve of St. LouisAll of these are by-products of structural changes taking place in North America, much of Europe and Japan – which are all grappling with how to provide services to populations that are aging while retooling to compete in a more competitive and more volatile global environment. Central Banks in the US, Japan, and Europe have all undertaken extraordinary measures, buying bonds to keep borrowing rates low in an effort to stimulate growth – with limited success. At the same time, sovereign indebtedness has grown. On a positive note, US leaders have taken steps to enact a budget this year and talk is underway for a possible broad deal on the budget.

This is a delicate dance. The US will need both strength and flexibility to navigate challenges from ‘next wave’ dynamos like Brazil, China, India, and Korea, while avoiding conflict with potential spoilers in North Korea and Iran. Yet fiscal tightening, offset in part by stimulus efforts by the Fed, could keep US growth below 2%, leaving it vulnerable to shocks. Yes Virginia, there will be growth in the spring, but the seasons of growth feel as fleeting as the daffodils. L.K.

** Homage to ‘Being There’, a 1979 film starring Peter Sellers (his final role). Click for a link to its now classic scene; and background.

**Crying Wolf? or Meet me in the (Foggy) Bottom

The Sequester is here. The sky has not fallen – in fact, the DJIA has hit a new all-time high. Has the President been crying wolf? The quick and dirty answer is this: 1) people have tired of DC drama and have tuned out; 2) businesses and households continue their gradual recovery with housing, construction, and new orders picking up; and 3) a potentially more significant showdown looms later this month.

Read More...Let’s look at all three briefly. People have tuned out the noise from Washington, and perhaps rightly so, since we’ve had a series of fiscal showdowns ever since the summer of 2011. Despite the headlines and tales of woe surrounding the Sequester – (translation: automatic government spending cuts to take place over 10 years — starting with $85 billion by Sept. 30), it’s been a non-event. (Info on the Sequester HERE). The President may have overdramatized the immediate impact of these across the board cuts, but all sides agree this is a very crude solution – there’s no shortage of good ideas to trim spending and increase efficiency in the US Federal government [click HERE for policy ideas; and HERE for ideas on defense spending]. Comparing budget cutbacks to a crash diet, if you’ve got to drop weight fast, I’d go for liposuction over a machete.

Many people also wonder why they should care, if Wall Street doesn’t. The Dow Jones Industrial Average has traded above 14,000 for several sessions, back to levels last seen in 2007. Broader indices such as the S&P 500 have also recovered, up 125% from lows seen in 2009. Wall Street has chosen to skip the hyperbole and figures some ‘patch’ will be found. Instead they are focus on the private sector, which continues to improve. Yes, consumers have parted back spending after the payroll tax holiday expired in January, but unemployment claims continue to decline and hiring has notched higher, car and home sales have rebounded, and values of major assets – from homes to retirement portfolios – are rising. Some are betting the slow progress will continue in spite of Washington, others prefer the US to even weaker outlooks in Japan or Europe, and some think the market is overdone but figure they can get out before the music stops. Indeed, analysts have voiced concerns that the bull market in equities is near a peak, noting that trading volumes have fallen even though prices are rising, and a few contrarian investors have retreated to US Government bonds.

But wait, there’s more. A big reason why no one is paying Washington much mind is because the Federal Government is still open for business. The problem is that the Continuing Resolution that funds the US Government (since Congress can’t agree to an actual budget) will run out on March the 27th – which happens to be the full moon. While the impact of the Sequester will take some time to be felt, a total US Government shut-down would prove more far-reaching and dramatic (here’s a primer on the 1995-1996 shutdowns). Pundits have the usual three scenarios about what might happen – another extension of the Continuing Resolution (being considered by Congress as we write), a long term agreement which would truly enable the economy to take off (we can only hope), or a total shut-down which could potentially undo the progress beginning to take root. If you’ve missed the rally and are itchy to get in – you may wish to wait a bit longer to see how this works out. If you’re in and concerned, ask your advisor about whether it makes sense to take some profits – particularly if the February employment report (due out on March 8) provides a positive surprise.

Assuming that most of the budget cuts under the sequester take place, analysts estimate this would reduce US growth by 0.6% in 2013 – basically wiping out the pickup that economists forecasted for the year, keeping us locked in the 2% range seen since 2011. A government shut down could be worse, though the impact would depend on how long it lasted. Talk about a race to the bottom. If Washington keeps fumbling, we won’t be worried about whether the politicians were crying wolf – we’ll be too busy howling at the moon.

** We pay homage to legendary bluesman Howlin’ Wolf’s classic, Meet me in the Bottom.

Shrinkage**

Source: You Tube

Source: You TubeAnalysts had expected that growth in the final quarter of 2012 would come in sluggish, warning about a temporary pullback after Hurricane Sandy, but no one had forecasted that it would actually contract 0.1%, the first outright decline since 2009. A look at the data revealed that this was due mainly to a sudden sharp drop in government spending and a big dip in inventory restocking by businesses.

Read More...

Should we worry about the possibility of a new recession? Not yet. So far, it looks as if this was “shrinkage” – a temporary dip in economic activity due concerns the ‘fiscal cliff’ would hit January 1st, but was averted. And the good news is that 2013 has started on a more positive note. The economy created 157,000 additional jobs in January, close to expectations, but gains were revised sharply higher for latter part of last year, which helped support spending and activity. According to the Bureau of Labor Statistics, these upside revisions helped bump up payroll increases to 180,000 per month, compared to the roughly 150,000 average seen for much of 2012. Hourly earnings crept up 0.2% in January, after a 0.3% rise in December – not huge, but still a plus.

A recovering housing market also helps. Although existing and new home sales both dipped in December, this came after big gains in November. Low inventories of homes for sale (and not weaker demand) was cited as a reason for the drop, with supply of existing homes down to 4.8 months of sales, versus a norm of about 6 months. Much of the extra supply from the housing and foreclosure crisis has been worked off, and this, combined with rising demand has begun to push home prices higher. Auto sales have also benefitted from a more resilient consumer, with January motor vehicle sales rising at a 15.3 million pace, a bit off the peak of 15.5 million in November 2012 (a post-Sandy spike), but still well above the 14.2 million rate of seen a year ago and the strongest performance since 2007.

The housing sector looks like it will continue its rebound in 2013, and stock markets have followed suit. The Dow Jones Industrial Average closed above 14,000 last week for the first time since October 2007, just before the start of the Great Recession.

The main wrinkle is while the private sector and households have been getting their act together, the public sector remains at an impasse over spending. The ‘fiscal cliff’ agreement raised some taxes on wealthy taxpayers and reversed the temporary cut in payroll taxes that fund Social Security, but it will have a limited impact on either the annual budget deficit or the large overhang in existing debt of the Federal government. The ‘fiscal cliff’ deal postponed automatic spending cuts for 60 days, and Congress passed a temporary ‘suspension’ of the debt ceiling for a few months. Both issues will likely remain a driver of sentiment in the weeks and months ahead.

The good news is that the private sector has made slow but steady progress and the US budget deficit is likely to decline below $1 trillion this year according to the non-partisan Congressional Budget Office, but growth remains in low gear. If US leaders take action to address the long term debt issue, it would help resolve the uncertainty holding back the economy, investment, and new hiring. But if Washington continues to kick the can down the road, investors could get skittish again, impacting confidence. And that in turn, leaves us vulnerable to another bout of ‘shrinkage’. Stay tuned.

*Shrinkage can relate to accounting and laundry, but it entered the popular lexicon after an episode of the comedy Seinfeld.

SANDY & US ELECTION UPDATE

Credit: Nyack-Piermont Patch, October 30, 2012

The Sandy Surprise

Sandy – the aurora is risin’ behind us The pier lights our carnival life on the water

Bruce Springsteen, 4th of July, Asbury Park (Sandy)

Having finally made it through the 2012 US elections, one wonders whether 2+ years of campaigning and billions of dollars spent were worth it. President Obama won reelection to a second term, while the Democrats and Republicans maintained control of the Senate and House of Representatives, respectively, albeit with smaller majorities. Having said that, several trends did emerge, and as many have warned, markets have already started to pivot to the elephant in the room: the fiscal cliff. Here are our four take-aways:

Read More...• Extreme ‘Anti’ Strategies Lost (immigrant, abortion, tax, etc.) Candidates that adopted virulent ‘anti’ rhetoric were defeated. Anti-abortion candidates Todd Akin of Missouri and Richard Mourdock of Indiana lost US Senate races after outrageous remarks; anti-immigration efforts hurt Republicans in swing states (Florida, Colorado, Nevada). In addition, several Tea Party candidates defeated or pressured moderates to stand aside in primaries lost to moderates in the general elections (Maine, Pennsylvania, Connecticut, etc.).

• Demographics Rule: Latino voters crossed the 10% threshold in this election, and together with African-Americans, women, and younger voters, were key to President Obama’s win, as well as initiatives on same-sex marriage. The Republican coalition of older, white, religious, and affluent voters comprised a shrinking proportion of voters and will need to expand to remain viable. Pundits believe this bodes well for immigration reform.

• The ‘Sandy’ Surprise: Hurricane Sandy stopped Mitt Romney’s late surge and helped President Obama. Exit polls sited by one network said that 4 in 10 voters said the hurricane had a modest or significant impact on their final choice. Cooperation and effective management of the storm crisis by President Obama and New Jersey Governor Chris Christie won widespread support, with support from New York Governor Cuomo and Mayor Bloomberg, who noted that climate change issues were one factor that tipped him into supporting the President for reelection.

• Leadership Trumps Partisanship. Drawing on earlier points, politicians who demonstrated leadership and got things done were seen as a welcome change to the hyper-partisan gridlock. House Speaker Boehner got the memo, saying the elections were a mandate for the two parties ‘to take steps together’ to boost the economy. President Obama talked about ‘compromises to move the country forward’. Others however have not, and has businesses nervous.

Concerns about the ‘carnival life’ in Washington (as well as trouble in Europe) pushed US stock markets sharply lower today (down 2.3-2.5%); their worst session since June. As we move to year-end investors and money managers will be tempted to lock in profits (and bonuses) and reduce exposure to markets, as we head to the holidays, which could put pressure on stock markets. This may be exacerbated by investors locking in profits at lower capital gains rates in case those rise in the future.

And with little change in net seats for either party in Congress, the pressure is on for legislators to work immediately toward a ‘grand bargain’, or at least a temporary moratorium on pending spending cuts and tax increases to give the new Congress time to work on a broad-based reform. This package will need to include a combination of spending limits and revenue increases to reduce the fiscal gap and longer term fixes to reduce the national debt. It will involve changes to Social Security (a higher retirement age perhaps), cost controls for defense, Medicare and Medicaid (health care costs remain the crux of the problem), and reduction of tax cuts, corporate incentives and other special incentives. These four areas comprise, together with interest on our existing debt, over 80% of government spending. Like banks, it’s ‘where the money is’.

Just as Hurricane Sandy demonstrated that environmental ‘events’ carry serious ‘tail’ risk for government, business, and households (low odds, but devastating impact), the fiscal cliff poses serious risks for the US and global economy. Typically economists talk about hurricanes as a one-off temporary hit to growth (of 0.45%), followed by a bump up when rebuilding efforts get underway. Moody’s Analytics estimates $50 billion in losses from Sandy (versus $80-90 billion from Hurricane Katrina). Regardless of your views on climate change, businesses will need to think about how to reduce risk from these ‘100 year floods that seem to be happening every two years’.

The good news is that the private sector continues to improve. Consumers have reduced spending and cut debt to help get their households in order, while the rebound in housing activity has helped reduce roadblocks to growth as sales and construction increase, supply shrinks, and prices rebound. The Census Bureau announced that the US added 1.15 million households in the 12 months that ended in September, up from 650,000 average of the previous four years. However until we see constructive action by the public sector, the economy will remain stuck in low gear.

Lisa Kaess * Sandy (4th of July, Asbury Park) was one of Bruce Springsteen’s early ballads, merging a coming of age story with a description of summers on the Jersey Shore. The YouTube link has a video of the song from 1975.

FEELIN’ GOOD

It’s a new month and a new quarter and

some folks are feelin’ good.

The benchmark US Dow Jones Industrial Average hit a 5 year-high, buoyed by large drop in the jobless rate to 7.8%, the lowest level since President Obama took office. While this was good news for Mr. Obama, it’s also a new day for Republican candidate Gov. Mitt Romney after a strong performance at the first Presidential Debate. Is this a new dawn?

Read More...The headline you’ll hear about is a 0.3% drop in the unemployment rate to 7.8% in September, from 8.1% in August. By contrast, net new jobs rose by a lackluster +114,000 last month (seasonally adjusted), barely enough to keep up with population growth. This triggered accusations that the ‘Chicago gang’ fixed the numbers a month before Election Day. However July and August payroll gains were revised higher by over 80,000 jobs (to 142,000 and 181,000, respectively), and the Bureau of Labor Statistics (BLS) announced benchmark revisions that indicate it had previously underreported job growth by nearly 400,000 earlier in the year. Add in questions about seasonal adjustments (the process to ‘smooth out’ seasonal swings may have an upward bias to autumn/winter) and a very large jump in part-time employment in a survey of households, and you end up with muddled mess.

What we can say is that monthly job gains have averaged close to 150,000 this year, leading to a gradual decline in unemployment, and that the US economy enters the 4 the quarter with slightly faster growth. And we do mean slightly, since growth in the 2 nd quarter was revised down to 1.3% annual growth rate (originally reported as +1.7), and the current flash estimates by leading analysts for the 3 rd quarter are about 1.9%. This is supported by data showing an uptick in home prices, a large jump in applications for new and refinanced mortgages, and the strongest pace of vehicle sales last month since March 2008. They offer reasons to be cheerful, but hardly a celebration.

Markets however have found a sweet spot for the moment, and though many key indices closed lower, they continue to advance. An improving job market has buoyed consumer confidence, triggering an upturn in the use of credit to finance new cars, student loans, and other purchases. That has led to optimism about both quarterly earnings and the upcoming holiday season. At the same time, the Federal Reserve’s policy to maintain low interest rates for an extended period is aimed to mitigate downside risk. The Fed’s actions have been echoed by similar actions by central banks in Europe and Japan.

While central bankers helped get this party started, watch out for possible spoilers. Food prices remain below highs in early 2011 that triggered riots and the Arab Spring, but have rebounded toward highs seen in 2008, which led to crisis conditions in low income countries. Oil prices continue the see-saw trading pattern we’ve had all year and are now back below $90/barrel, but could easily rebound. Geopolitical conflicts continue to simmer, with skirmishes between Turkey and Syria, while economic sanctions against Iran are taking a toll, leading to foreign exchange controls and skyrocketing import prices, which could trigger hyperinflation (and may have already). And European finance ministers meet again early next week amid speculation whether Spain will formally request assistance, while Greece has yet to convince its creditors that it has a credible deficit reduction plan, a prerequisite for disbursement of new funds. And a month from now, 2 assuming a clear election outcome, the negotiations over the expiration of the Bush tax cuts and ‘fiscal cliff’ will begin. Feelin’ good yet? LK

*Thirteen year-old Carly Rose Sonnenclair sings Nina Simone’s classic, Feelin’ Good. (Start at 1:45). And here’s the original by the incomparable Nina Simone.