Analysts had expected that growth in the final quarter of 2012 would come in sluggish, warning about a temporary pullback after Hurricane Sandy, but no one had forecasted that it would actually contract 0.1%, the first outright decline since 2009. A look at the data revealed that this was due mainly to a sudden sharp drop in government spending and a big dip in inventory restocking by businesses.

Federal Government outlays declined -6.6% in the fourth quarter of 2012, compared with a 3.9% increase in the third quarter of 2012, led by a 22% plunge in defense spending. And business inventories rose at one third the rate of the previous quarter and half the rate seen last summer. Households helped offset these declines as personal consumption rose 2.2%, compared with a 1.6% rate in the previous quarter, led by a 13.9% jump in durable goods orders, which may be related to post-Sandy replacement spending. For 2012 as a whole, the US grew at a 2.2% annual rate, versus 1.8% in 2011.

Should we worry about the possibility of a new recession? Not yet. So far, it looks as if this was “shrinkage” – a temporary dip in economic activity due concerns the ‘fiscal cliff’ would hit January 1st, but was averted. And the good news is that 2013 has started on a more positive note. The economy created 157,000 additional jobs in January, close to expectations, but gains were revised sharply higher for latter part of last year, which helped support spending and activity. According to the Bureau of Labor Statistics, these upside revisions helped bump up payroll increases to 180,000 per month, compared to the roughly 150,000 average seen for much of 2012. Hourly earnings crept up 0.2% in January, after a 0.3% rise in December – not huge, but still a plus.

A recovering housing market also helps. Although existing and new home sales both dipped in December, this came after big gains in November. Low inventories of homes for sale (and not weaker demand) was cited as a reason for the drop, with supply of existing homes down to 4.8 months of sales, versus a norm of about 6 months. Much of the extra supply from the housing and foreclosure crisis has been worked off, and this, combined with rising demand has begun to push home prices higher. Auto sales have also benefitted from a more resilient consumer, with January motor vehicle sales rising at a 15.3 million pace, a bit off the peak of 15.5 million in November 2012 (a post-Sandy spike), but still well above the 14.2 million rate of seen a year ago and the strongest performance since 2007.

The housing sector looks like it will continue its rebound in 2013, and stock markets have followed suit. The Dow Jones Industrial Average closed above 14,000 last week for the first time since October 2007, just before the start of the Great Recession.

The main wrinkle is while the private sector and households have been getting their act together, the public sector remains at an impasse over spending. The ‘fiscal cliff’ agreement raised some taxes on wealthy taxpayers and reversed the temporary cut in payroll taxes that fund Social Security, but it will have a limited impact on either the annual budget deficit or the large overhang in existing debt of the Federal government. The ‘fiscal cliff’ deal postponed automatic spending cuts for 60 days, and Congress passed a temporary ‘suspension’ of the debt ceiling for a few months. Both issues will likely remain a driver of sentiment in the weeks and months ahead.

The good news is that the private sector has made slow but steady progress and the US budget deficit is likely to decline below $1 trillion this year according to the non-partisan Congressional Budget Office, but growth remains in low gear. If US leaders take action to address the long term debt issue, it would help resolve the uncertainty holding back the economy, investment, and new hiring. But if Washington continues to kick the can down the road, investors could get skittish again, impacting confidence. And that in turn, leaves us vulnerable to another bout of ‘shrinkage’. Stay tuned.

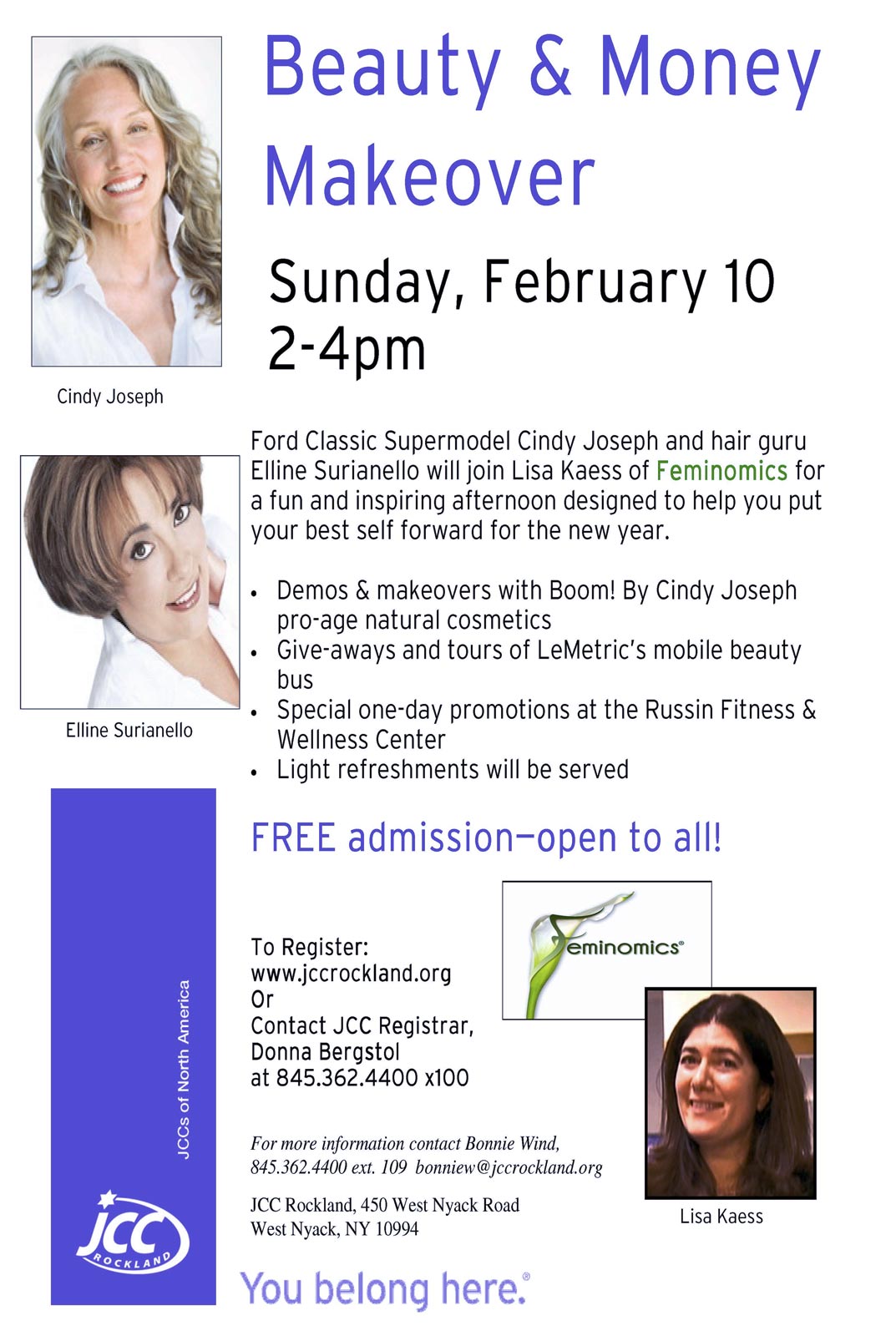

Lisa Kaess

*Shrinkage can relate to accounting and laundry, but it entered the popular lexicon after an episode of the comedy Seinfeld.