Now Would be a Good Time to Lead:

Speaker of the House John Boehner & President Obama

(Photo source: Washington Post, The Fix, July 2011)

Take it to the (Debt) Limit — One More Time**

Growth in the US during the second quarter (Q2) was confirmed at a 2.5% annual rate, better than first reported and well above levels seen at the start of the year. A modest but steady recovery was echoed overseas, with China on track to meet its 7.5% GDP estimate, Japan growing at a 3.8% annualized rate thanks to a major stimulus program, and even the Eurozone expanded at a 1.2% annual rate this spring.

But just when you thought we might be on the way to a sustainable recovery, US lawmakers have once again locked horns on fiscal issues. Republicans in the House of Representatives have taken the US government hostage, putting forth their list of demands before they release funding or agree to raise debt ceiling. They include a one-year delay in the implementation of Obamacare, tax reforms along the lines of Paul Ryan’s budget, passage of the Keystone XL Pipeline, drilling for oil on Federal land, and more in a lengthy laundry list. Even Republican advisors and allies call these tactics ‘ill conceived’ and warn that ‘kamikaze missions rarely turn out well’.

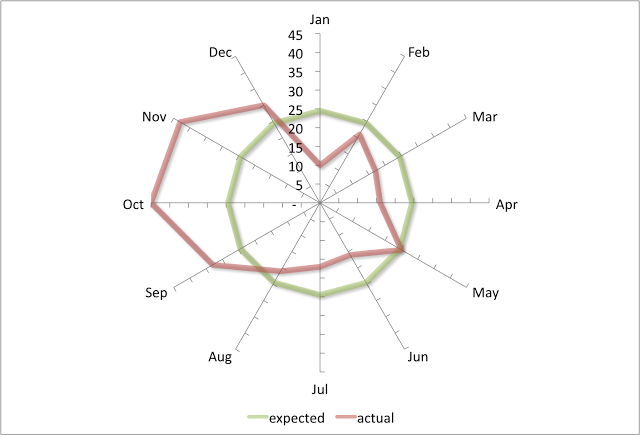

Washington’s games could cut into recent gains for the US economy. The housing sector, which was revised higher in the GDP report, has decelerated a bit in response to the jump in mortgage rates and higher prices, but continues to expand. Autos and light truck sold briskly, breeching the 16 million unit annual rate in August for the first time in nearly six years. While manufacturing figures softened a bit in the summer, new orders are up sharply, and durable goods orders steadied in August after a sharp drop in July. Domestic energy production continues to grow at a robust rate, which has the added plus of reducing energy imports from abroad, while inflation remains tame. And with initial jobless claims averaging 308,000 the last month, its lowest point since the downturn, analysts expect hiring to pick up over the next few quarters.

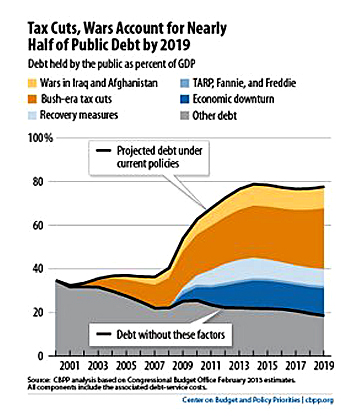

Wall Street and Main Street have largely ignored the political noise because this deeply flawed process has produced results. Thanks to higher than expected tax receipts, income from Fannie Mae & Freddie Mac, and spending cuts, the US Federal Budget deficit has narrowed to roughly -4% of GDP for fiscal year ending September 30, less than half the -10% of GDP gap recorded in fiscal year 2009. That said, the $16.7 trillion pile of debt, equal to about a full year of GDP, has yet to be dealt with in a meaningful way.

So what’s next? Beware the Ides of October: Officials have started to brace for a possible temporary government shutdown starting next Tuesday, October 1. In practical terms it means that, should a temporary shut-down occur, essential services and payments would continue (like Social Security payments), but non-essential services would close. Here’s a list of agencies and links to contingency plans. Macroeconomic Advisors, a leading consultancy, estimates that a temporary government shut-down could reduce US growth by 0.3% in the fourth quarter, with a rebound in early 2014, similar to the drop in growth in the first quarter, followed by a rebound this year. But remember, because the US is very close to its debt ceiling (Treasury Secretary Lew estimates it will exhaust funding measures October 17), this impasse carries the threat of a sovereign default by the US on its obligations.

Risky Business: The largest concentration of “1% worst trading days” in the history of the Dow (Jones Industrial Average) have occurred near October. NOT a good time for a debt ceiling showdown.

Source: Statisticalideasblogspot.in – “The Autumn of Our Discontent” by Salil Mehta

And unlike the fiscal battles of August 2011 and last December, this debt ceiling impasse comes at a sensitive time, for October is highly correlated with stock market ‘events’. News outlets have reported how September has often been the worst month for financial market returns, but a statistical review by Salil Mehta of the worst 1% trading days in the history of the Dow Jones Industrial Average (Dow) indicates that the riskiest times have occurred near October, with a bias toward Mondays (to qualify for this “1%”, index had to fall by 3.2% or more in a single session, or nearly 500 points at current levels). Corporations begin reporting their third quarter earnings results October 8th, and already a number of companies have ‘guided’ expectations lower. With equity indices hovering near multi-year highs, Washington’s missteps could prove costly.

Against this backdrop, it’s no wonder that Federal Reserve officials opted to maintain its extraordinary stimulus efforts a bit longer. Taking a bit of flack for ‘misleading markets’ or ‘missing an opportunity’ may be the least of their concerns. With just a few days to go, pundits warn a temporary government shut-down could well occur, enabling hard liners to show they ‘delivered’ on their threat, clearing the way for another continuing resolution to fund the government, with a possible extension of automatic spending cuts (the sequester) into the 2013-2014 fiscal year. A temporary shut down could focus Wall Street’s attention in a hurry, reminding everyone of the potential costs to business, households, and the real economy. That’s messy but manageable. But as we learned with the housing crisis, just because something hasn’t ever happened yet doesn’t mean it can’t.

America’s sovereign ‘debt mountain’ — it won’t disappear by itself and a default, even temporary, could trigger sharp increases in borrowing costs (like a missed payment on a credit card), impacting mortgages, lines of credit, and business loans.

Source: Center on Budget and Policy Priorities, Daily Beast

** Since this is ‘déjà vu all over again’ we return to the classic Eagles hit, Take it to the Limit. Here’s a link to a video of a live performance.

Thanks so much for your support!!

Please let us know if you have ideas for future segments, and we hope you’ll take a moment to ‘Subscribe’ to the Feminomics You Tube Channel, ‘Like’ our videos, our Feminomics Facebook Page, and follow us on Twitter.