It’s been a long, a long time coming

But I know a change gonna come

(Sam Cooke – 1963)

From civil unrest around the globe, prayers for the ailing Nelson Mandela, to landmark Supreme Court decisions, we are witnessing chapters drawing to a close as others struggle to emerge. With change comes uncertainty and volatility, which could also describe financial markets of late. Yields on US Treasury securities were backing up for weeks, but Federal Reserve Chairman Ben Bernanke’s announcement that the Fed could begin tapering down its purchases of fixed income securities later this year sent yields sharply higher. The US Treasury 10-year note yields 2.48%%, up from 1.6% in early May; this in turn pushed the average 30 year mortgage rate to 4.375%, versus 3.75% a month ago.

Current economic conditions hardly justify such a swing. The Federal Reserve’s survey of activity noted modest improvement in May, with interest rate sensitive sectors rebounding sharply. Existing home sales rose at a 5.18 million annual rate in May, new home sales rose at a 476,000 annual rate, with average home prices up about 12% year on year, (even more in Florida and Western cities). Auto sales, which have averaged just over a 15 million units annualized sales pace this year, could reach 15.7 million units in June, their best showing in 6 years. Nevertheless, higher taxes, ongoing public sector budget cuts, and limited wage gains continue to temper any economic upswing. Growth (using gross domestic product or GDP) was revised down in the first quarter to a 1.8% annual rate (from 2.4%); forecasts for the second quarter growth remain below 2%.

Let’s be clear – the Fed has not taken any action yet. Its purchases of US Treasuries and mortgage securities, which are running at $85 million per month, will remain steady for now, with the plan to slowly reduce them later this year – should conditions warrant. Chairman Bernanke and senior officials have emphasized its Fed Funds target rate remains unchanged at 0 – 0.25%. Fed parameters say it will consider raising benchmark rates when headline unemployment falls below 6.5% and inflation rises about 2.5%. With inflation subdued for now at less than 1.5% annual rate, and headline unemployment a full percent below the Fed’s target, we’ve got a ways to go. Forecasters anticipate a gradual acceleration in US growth starting later this year, leading to an eventual tightening of monetary policy later in 2014 to early 2015.

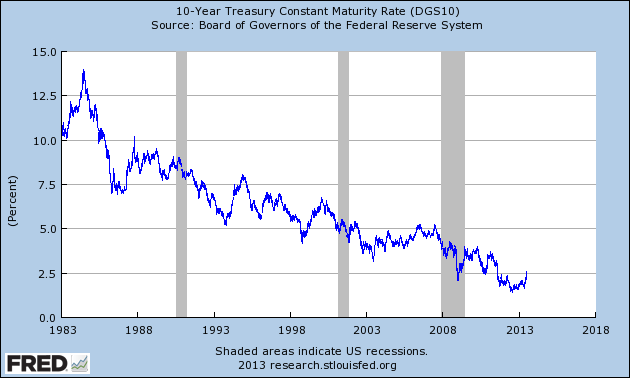

So if growth remains modest and the Fed’s overnight borrowing rate will remain near zero, why the sell-off? The chart below of 10 Year US Treasury yields, shows that in the big picture, US interest rates have steadily moved lower since the mid-1980s. While some investors may be perfectly willing to hold their securities to maturity, others – especially those who trade regularly – read the Fed’s announcement as a signal that this trend has likely run its course. So they’ve begun to sell their holdings to lock in profits.

Are we witnessing the end of an extended decline in US bond yields?

(Source Federal Reserve Bank of St. Louis)

And the numbers confirm this move — bond funds and exchange traded funds faced record redemptions of $61.7 billion through June 24th, surpassing the previous record of October 2008. At the same time, money market funds saw assets rise by over $8 billion in the week ending June 25, indicating some investors have decided to get out of the market and hold their money in these low yielding short term funds to keep their options open.

That makes good sense, because a number of wildcards continue to concern markets. Once again international events and geopolitical pressures pose more of a threat than economic imbalances, though global growth forecasts have been revised lower. For example, Chinese authorities, in an effort to send a message to banks that it intends to rein in lending excesses, Chinese did not step in at quarter-end to address rising cash needs, resulting in a spike in short term interbank lending rates. With Chinese banks needing liquidity, they sold US Treasuries (and other holdings), exacerbating a spike which sent the 10 year yield to 2.71%, with some watchers speculating that cash strapped Chinese might have sold US Treasuries temporarily to raise liquid funds. Having made their point, the Peoples Bank of China intervened on June 25th, providing liquidity to the market, easing pressures.

We are reminded that just as early signs of recovery were derailed in 2011 by the Arab Spring and tsunami in Japan, civil strife in a number of countries, slower growth in China, and other surprises could potentially rain on our parade again. As events in Egypt have deteriorated rapidly, investors fled mutual funds focusing on emerging market bonds, withdrawing estimated $5.6 billion in the week ending June 26.

Ironically, the Fed’s discussion on withdrawing its unprecedented support of financial markets represents a sign of healing. And with the US budget deficit shrinking rapidly, authorities may reduce auction sizes in coming months, so that the ‘tapering down’ of extraordinary bond purchases would coincide with a period of dwindling supply. Nevertheless markets have become accustomed to this IV drip of money, and they are demonstrating symptoms of withdrawal. These developments remind us linkages in our markets and global economy tether us closer together than ever. And given the rise in foreign holdings of US Treasury securities, the impact now goes in both directions. So take a deep breath, because a change ‘gonna come.

** Sam Cooke’s classic, A Change Gonna Come (listen here), became an anthem of the US civil rights era, and adopted by agents of change around the world.