We welcome the inevitable seasons of nature,

But we’re upset by the seasons of growth in our economy.

(From the film, Being There – click HERE for clip)

After an unexpected pull-back in the economy late last year as the US teetered on the ‘fiscal cliff’, politicians, analysts, investors, and gardeners shared the view that yes, there will be growth in the spring. Stronger demand for housing and autos, a catch-up spurt in manufacturing to replenish low inventories, and ongoing business investment combined to offset tighter fiscal policy. Growth in the first quarter of 2013 (due out April 26) will rebound sharply from the paltry 0.4% gain (itself an upward revision) posted in late 2012, with some analysts forecasting a 3% annualized rate. While Americans did not feel the impact of spending cuts that went into effect last month (see Crying Wolf? commentary ), they have begun to surface. The combined impact of $85 billion in automatic spending cuts which came into effect last month together with earlier budget cutting agreements will effectively cancel out the extra momentum that had begun to build. That keeps the US stuck in a slow growth loop.

The March employment report is a case in point. Payroll job gains slowed substantially, up only 88,000, less than half the average gain of the past 12 months (169,000), with weakness in the retail sector, sluggish gains in manufacturing, and ongoing trimming of public sector payrolls. Unemployment ticked down to 7.6%, not because of job gains, but because nearly ½ million people stopped looking for work altogether. One report does not make a trend, and need a bit more time to see how much of this may be attributed to the harsher weather in March, early Easter, and the impact of budget cuts.

Different year, same pattern – activity begins the year on a positive note and slows into the spring. In 2011 it was the earthquake in Japan and Tsunami combined with the Arab Spring, and in 2012 growth slowed in China while the Greek financial crisis and its impact on the Euro took center stage. And fiscal tightening and debt drama has taken its toll on US growth. Less than a fortnight ago Chairman Ben Bernanke and senior policy makers at the Federal Reserve began discussing how they might eventually begin to withdraw the extraordinary stimulus measures taken to support growth. If the latest data indicating some softening of the labor market and a somewhat slower growth momentum going into the spring hold true, we could see yet another ‘spring slowdown’.

The same holds true for Europe, where the financial sector meltdown in Cypress looks unlikely to rock the core of the Eurozone, however the deep spending cuts imposed by governments to close large budget gaps, has the region mired in a vicious negative circle. Unemployment reached 12% for the Eurozone overall in February, the highest level recorded (data since 1995), with sharp regional differences. Youth unemployment topped 55%% in Spain and Greece, 38% in Italy, while unemployment (overall) was 7.7% in the UK an 5.4% in Germany. The European Central Bank forecasts that growth will decline another -0.5% in 2013, with no clear path back to growth.

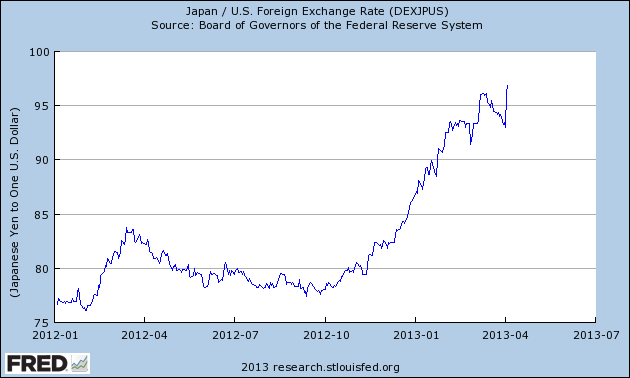

That is something Japan can also relate to – after all, it has had a lost decade with virtually no growth and is stuck in a deflationary spiral and a series of short-lived governments. Prime Minister Abe has embarked on a bold new policy to jumpstart growth and ‘reflate’ the economy – flip it from a negative spiral of falling prices, wages, and output into a more virtuous circle. Bank of Japan Chief Kuroda has a 2% inflation target , but detractors warn the country risks creating a ‘race to the bottom’ in international currency markets. Already the Yen has fallen sharply against major currencies this year, declining from 86 Yen per dollar in January to 99 Yen to the dollar today.

Source: Federal Reserve of St. Louis

Source: Federal Reserve of St. LouisAll of these are by-products of structural changes taking place in North America, much of Europe and Japan – which are all grappling with how to provide services to populations that are aging while retooling to compete in a more competitive and more volatile global environment. Central Banks in the US, Japan, and Europe have all undertaken extraordinary measures, buying bonds to keep borrowing rates low in an effort to stimulate growth – with limited success. At the same time, sovereign indebtedness has grown. On a positive note, US leaders have taken steps to enact a budget this year and talk is underway for a possible broad deal on the budget.

This is a delicate dance. The US will need both strength and flexibility to navigate challenges from ‘next wave’ dynamos like Brazil, China, India, and Korea, while avoiding conflict with potential spoilers in North Korea and Iran. Yet fiscal tightening, offset in part by stimulus efforts by the Fed, could keep US growth below 2%, leaving it vulnerable to shocks. Yes Virginia, there will be growth in the spring, but the seasons of growth feel as fleeting as the daffodils. L.K.

** Homage to ‘Being There’, a 1979 film starring Peter Sellers (his final role). Click for a link to its now classic scene; and background.